- Home

- Business Segment Overview

- Oils and Meal Business

Business Segment Overview

Oils and Meal Business

The Nisshin OilliO Group, Ltd., began selling Japan's first salad oil, Nisshin Salad Oil, in 1924. As a leading company in the edible oils market, we have consistently offered a broad lineup of products that utilize our technical capabilities. We will continue to harness "the natural power of plants" to deliver good taste and health, and provide everyone with a rich and varied diet.

Product Lineup

Edible Oils for Household Use

Healthy oils, canola oil, salad oil, olive oil, sesame oil, gift packages, others

Edible Oils for Commercial Use, Edible Oils for Food Processing, Processed Oils and Fats

Healthy oils, canola oil, salad oil, olive oil, sesame oil, soybean oil, rapeseed oil, linseed oil, palm oil, functional oils, margarine, shortening, products for chocolate, others

Business Overview

Edible Oils for Household Use

Main Measures

- We increased sales of value-added products such as Healthy Resetta and Healthy Choleste.

- The launch in March 2011 of Karada ni Daizu Yasashii Abura (healthy soybean oil rich in Vitamin E) and Olive & Grape Seed Oil enhanced our lineup of high-value-added products, stimulated demand for edible oils and invigorated the market.

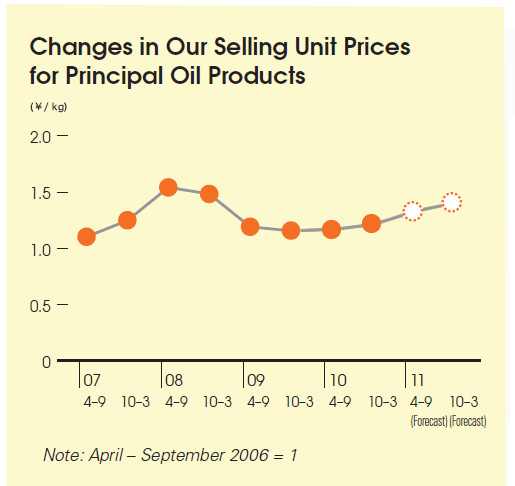

- Retail prices were adjusted in line with costs.

Sales Trends

- Sales volume was on a par with the previous fiscal year, but because of the difficult business environment we were unable to revise prices as we had hoped, and the sales amount declined year on year.

- Sales of gift packages were on a par with the previous fiscal year in terms of both volume and price, despite the tight market.

Edible Oils for Commercial Use

Main Measures

- We boosted sales of high-value-added products such as premium oils.

- Prices were adjusted in line with costs.

Sales Trends

- Sales volume was flat overall year on year, as increases in sales of high-value-added products were offset by declines in general-purpose oils due in part to the effects of the Great East Japan Earthquake.

- Selling prices were steadily revised in the second half of the period, but owing to the difficult business environment the extent of these revisions was less than we had anticipated.

Oils and Fats for Food Processing

Main Measures

- We focused on price revisions.

Sales Trends

- Sales volume declined year on year as a result of the prolonged economic slowdown, and greater competition both domestically and overseas.

- We raised selling prices slightly in the first half of the period, and to a greater extent in the second half.

Processed Oils and Fats

Sales Trends

- Sales volume steadily increased, centered on specialty fats.

- The average selling price was down slightly from the previous fiscal year, due mainly to a greater proportion of sales from low-priced items.

Oil Meal and Grains

Sales Trends

- Sales volume declined year on year due to a sharp fall in domestic production of soybean oil and oil meal.

- Raw material prices rose, but the selling price of meal declined year on year. This was due mainly to the high value of the yen, and a decline in the price of meal globally.

Overseas Business

Dalian Nisshin Oil Mills, Ltd.

Dalian Nisshin Oil Mills, Ltd.

Sales Trends

- Sales in the Chinese market were sluggish during the first half, but we secured earnings through expanded sales to Japan. Second-half revenue rose sharply on improved profitability.

Intercontinental Specialty Fats Sdn. Bhd. (ISF)

Intercontinental Specialty Fats Sdn. Bhd. (ISF)

Sales Trends

- Sales volume and amount rose as a result of expansion of production facilities and an increase in exports.

- Earnings declined year on year as a portion of earnings was deferred to the next fiscal year due to variations in the palm oil market.

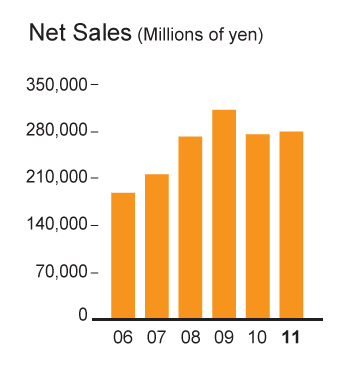

Business Results

As a result, net sales in the Oils and Meal Business segment rose 1.5% from the previous fiscal year to ¥280,324 million, although operating income declined 42.3% to ¥5,275 million.